Introduction

As we advance in age, the importance of financial security and long-term growth cannot be underestimated. The golden years should be a time of relaxation and enjoyment, made possible by a solid financial foundation.

For seniors, this implies engaging in safe financial investments that not only preserve their hard-earned savings but also provide an avenue for sustained growth.

The landscapes of risk and return change as we grow older, making it imperative to choose wisely and tailor our investment strategies to align with this life stage.

Through meticulous research and careful consideration, seniors can identify the best financial investments that ensure stability, growth, and peace of mind in their retirement years.

Choosing the Right Investment

Choosing the right senior investments requires meticulous consideration and planning. Various factors must be evaluated, including your financial goals, time horizon, risk tolerance, and future needs, and not wanting to lose money.

Diversification is key – investing in a variety of asset classes can mitigate risk and ensure a steady flow of income throughout retirement.

It’s also crucial to consider your future financial needs; given the rising costs of health care and long-term care services, a portion of your portfolio should be devoted to covering these potential expenses.

Remember, your investment portfolio goal is not just to preserve your wealth but also to grow it in a way that keeps pace with inflation and sustains your standard of living in your golden years.

What Is the Best Investment Plan for Seniors?

The best plan for senior citizens depends on their individual goals, risk tolerance, and financial needs. A well-rounded portfolio should include a variety of safe low-risk investments such as stocks, bonds, ETFs, real estate, and money market accounts.

It is also important to have a diversified portfolio of different asset classes to protect your wealth from any downturns that may occur during retirement years.

Additionally, seniors should consider alternative investments like gold and silver, venture capital funds, and real estate crowdfunding to make the most of their retirement savings.

Finally, seniors should consult with a trusted financial advisor who can help them create an investment plan tailored to their individual needs. With careful planning and research, seniors can make informed decisions about their investments and ensure a secure future for themselves.

Investing now is the key to a prosperous retirement!

The Best Conservative Investments for Seniors

Treasury Bonds (T-Bonds)

Treasury bonds are issued by the U.S. government and provide a safe investment option for treasury bills with low risk and yields above inflation rates. These bonds come in two varieties: long-term treasury bonds (with maturities over 10 years) and short-term treasury bonds (with maturities up to 10 years). T-bonds offer reliable returns with minimum volatility, making them a great option for seniors who are risk-averse and safe investments for seniors.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a type of savings product offered by banks and credit unions. They are safe investments for seniors with guaranteed returns, as long as the deposits are held until maturity. Seniors can benefit from CD’s low-risk and fixed-income characteristics, but yields tend to be lower than high-yield savings accounts and other investment options.

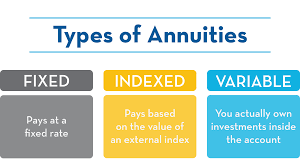

Annuities

Annuities provide a steady stream of income for retirees in exchange for premiums paid at the beginning of the contract. There are several types of annuities, such as fixed annuities, which can be tailored to fit the individual’s needs. As long as you select a reputable company, annuities provide a great way to ensure financial security and steady growth in retirement.

Mutual Funds

Mutual funds combine investments from a pool of stocks, bonds, and other securities. They are managed by professional investors who actively trade the fund’s portfolio based on market conditions. Most mutual funds provide diversification with low risk and offer solid returns over time. However, fees can be high, so it is important to research fees before investing.

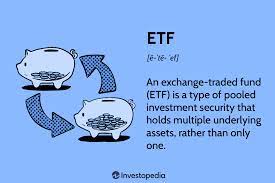

Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) combine elements of mutual funds and stocks. ETFs are traded like stocks but have the diversified risk profile of a mutual fund. They provide low fees, easy access to multiple asset classes, and tax advantages. Seniors should choose ETFs with solid track records for long-term growth potential.

Real Estate

Real estate investments can provide a steady stream of income for seniors. In addition to rental income, real estate investments appreciate over time, making them an attractive option for long-term investors. Also, real estate investment trusts could be considered. However, it is important to research the local market and look into potential maintenance costs before investing in real estate.

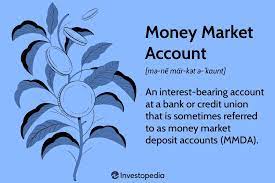

Money Market Accounts

A Money market account is a bank product that offers higher yields than regular savings accounts, with limited risk. Money market accounts have low minimum balance requirements, and some come with check-writing privileges. Most money market accounts also provide access to funds in case of emergency, making them safe investments for seniors looking for safety without sacrificing returns.

What Other Investment Opportunities Are Available for Seniors?

In addition to the seven safe investments listed above, seniors can also benefit from alternative investments. These include commodities like gold and silver, which serve as a hedge against inflation and currency fluctuations.

Additionally, seniors may find value in real estate crowdfunding or venture capital funds that have low minimum investment requirements. If properly researched, these investments can offer good returns with limited risk.

However, seniors should keep in mind that alternative investments are higher risk and less predictable than traditional safe investments mentioned earlier. As such, they should be approached cautiously and only used as part of an overall portfolio strategy.

What Other Factors Should Be Considered When Making Investments?

When it comes to making investments, seniors need to consider their individual needs and goals.

It is also important to take into account factors like inflation rates, tax implications, liquidity, fees, and current market conditions.

It is also essential that seniors stay abreast of the latest financial news and developments to stay informed on any changes that could affect their retirement income investments.

Additionally, seniors should consult with a trusted financial advisor who can provide sound advice and help them make informed decisions about their investments.

Finally, seniors need to remember that investing in retirement requires patience and discipline.

With proper research and strategic planning, you can ensure your golden years are as enjoyable as they were meant to be!

What are some Tips for Making Smart Investment Decisions?

When it comes to making smart investments, it is important to do your research and make informed decisions. Here are some tips that can help you get started:

- Stay updated on the latest financial news and developments.

- Consult with a trusted financial advisor who can provide sound advice and help you make smart decisions.

- Consider your individual goals, inherent market risk tolerance, and financial needs.

- invest across different asset classes to diversify your portfolio.

- Research alternative investments like gold and silver, venture capital funds, and real estate crowdfunding.

- Be patient and disciplined when it comes to making smart investments.

- Take advantage of tax breaks and other benefits available to seniors.

By taking the time to do your research, you can ensure that your investments are well-suited to your individual goals. With careful planning and research, seniors can have a secure retirement while still enjoying all the benefits of investing! So why not start today?

Make informed decisions and take control of your financial future. It’s never too late to start investing for your retirement!

Finding the Right Financial Advisor

Finding a trustworthy financial advisor is essential when it comes to making smart money market accounts investment decisions. When looking for the right advisor, it is important to consider the advisor’s experience, credentials, and reputation.

Start by getting referrals from family and friends or looking for advisors in your area who specialize in retirement planning and investments. Ask questions about their qualifications, fees, services offered, and any other relevant topics.

It is also important to make sure that you feel comfortable communicating with them as well.

Once you have found a few potential advisors, make sure to do your due diligence. Read through their website and check out their past reviews to get a sense of whether they are the right fit for you.

Finally, it is important to remember that finding the right financial advisor is an ongoing process. Make sure to review and assess your relationship regularly to ensure that you are still in good hands.

With the right financial advisor, you can rest assured that your investments and retirement plans will be well taken care of!

Bottom Line

Investing for retirement is complex and investments carry risk but are a necessary process. By taking the time to research and make informed decisions about your investment portfolio, you can enjoy a secure retirement and guaranteed income stream financial stability for years to come.

With proper planning and strategic thinking, seniors can ensure their golden years are as enjoyable as they were meant to be!

So why wait? Start investing today and reap the rewards! Good luck!

Do’s and Don’ts for Investing

As you prepare for retirement, it is important to understand the dos and don’ts of investing. Here are some tips to help you make smart and informed decisions:

Do’s:

- Stay up to date on the latest economic trends and news.

- Consult with a trusted financial advisor who can provide sound advice and help you make informed decisions.

- Research different investment options to diversify your portfolio.

- Take advantage of tax breaks and other benefits available to seniors.

Don’ts:

- Don’t be afraid to take risks, but make sure you understand the potential consequences.

- Don’t put all your eggs in one basket. Make sure to diversify across different asset classes.

- Don’t make hasty decisions when it comes to investing. Take the time to do your research and make informed decisions.

- Don’t forget to review and assess your investments regularly to ensure that your relationship with your financial advisor is still beneficial.

By following these tips, seniors can make smart and informed decisions when it comes to investing for retirement. With proper planning and research, seniors can have a secure future and enjoy all the benefits of their golden years! So why wait?

Take control of your financial future and start investing today! Best of luck!

Conclusion

In conclusion, choosing the right financial investments as a senior is crucial for long-term security and growth. Safe investment options such as bonds, dividend-paying stocks, mutual funds, and real estate can offer stable returns and help secure a comfortable retirement. However, it’s imperative to conduct thorough research and seek professional advice to make informed decisions. As each individual’s financial situation is unique, tailored strategies can ensure the best risk-reward balance for long-term financial growth. Remember, it’s never too late to build a robust financial future.

The main purpose of investing during retirement is to ensure financial security and growth over the long term. Each of the seven safe investments above has its advantages and drawbacks, so it is important to choose one that matches your individual needs and goals.

With careful research, seniors can find an investment plan suited for their current life stage. With the right strategy, you can reap rewards from carefully made financial investments in older age.

So, whether you are looking to preserve capital or achieve long-term growth – there is an investment plan right for you. With proper due diligence and research, seniors can enjoy financial security and stability in their golden years.

With a bit of patience and strategic planning, your retirement years can be as enjoyable as they were meant to be!